In the guide below, we will take a look at the 1095-C form and how to read and understand it.

Form 1095-C Frequently Asked Questions

What is a 1095-C Form?

A 1095c form is a record of the health insurance coverage that you were offered by your employer.

What actions do you need to take?

Information contained on the 1095-C may be of assistance when completing your federal income tax return for the 2024 tax year; however, the IRS has made clear that the 1095-C is not required for filing the Form 1040.

Two Important Terms You Might See

Minimum Essential Coverage – Minimum Essential Coverage – Coverage that AT LEAST meets the Affordable Care Act standards for what is considered adequate coverage

Minimum Value – Coverage that generally pays at least 60% of the total cost of medical services.

Taken together these terms mean that coverage provides adequate financial coverage for essential health services. Think of it this way: If the law requires that a policy covers an X-ray – that’s Minimum Essential Coverage; if the law also says that the policy must cover at least 60% of the cost of the X-ray – that’s Minimum Value.

Form 1095-C Instructions: How to Read and Understand This Form

The 1095 c is broken into three parts, let’s look at each part separately.

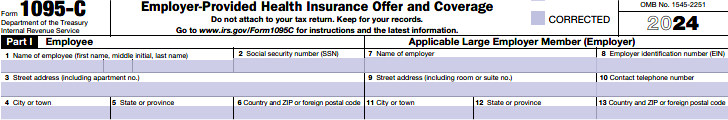

Part I:

This part contains information identifying the Employee and the Employer

Lines 1–6 contain all of your individual information such as name, address and Social Security Number.

Lines 7–13 contain information about your employer such as name, address, identification number and contact information.

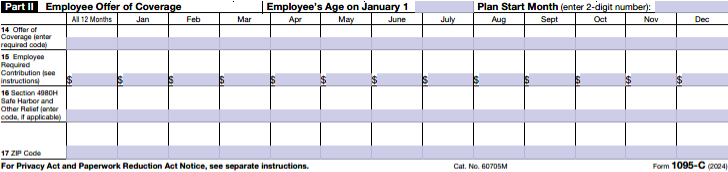

Part II:

This part contains information on the offer of coverage made by your Employer.

Part II of Form 1095-C is a monthly accounting of when you were offered health insurance, the cost of the plan, information about the plan value, and who was included in the offer of coverage. The good news is that your employer will already have populated the codes.

Employee’s Age on January 1 – Used for employers offering Individual Coverage Health Reimbursement Arrangements (HRA).

Plan Start Month – Displays the earliest plan start month as it applies to your offer of coverage. If you were not offered 00 would be entered as the plan start month.

Line 14 – This is where your employer communicated information about the coverage that you were offered. It reports whether your employer made an offer of coverage, the type of coverage and to whom the offer was made.

The IRS has assigned 18 different codes that might appear. Here they are with simple descriptions:

- 1A Minimum essential coverage providing minimum value, does not exceed the IRS affordability threshold for Federal Poverty Rate for single coverage. Offered to you, your spouse and your dependents.

- 1B Minimum essential coverage providing minimum value offered to you, but NOT your spouse or dependents

- 1C Minimum essential coverage providing minimum value offered to you and your dependents, but NOT to your spouse.

- 1D Minimum essential coverage providing minimum value offered to you, and your spouse, but NOT your dependents.

- 1E Minimum essential coverage providing minimum value offered to you, and minimum essential coverage offered to your dependents and spouse.

- 1F Minimum essential coverage NOT providing minimum value offered to you, you and your spouse, or you, your spouse and your dependents.

- 1G You were NOT a full-time employee during any month BUT you were enrolled in self-insured employer sponsored coverage for one or more months.

- 1H No offer of coverage.

- 1J Minimum essential coverage providing minimum value was offered to you and minimum essential coverage was conditionally offered to your spouse. Minimum essential coverage was not offered to dependents A conditional offer is subject to reasonable, objective conditions such as an offer to cover a spouse only if the spouse is not eligible for Medicare or a group health plan sponsored by another employer.

- 1K Minimum essential coverage providing minimum value was offered to you and your dependents and minimum essential coverage was conditionally offered to your spouse. A conditional offer is subject to reasonable, objective conditions such as an offer to cover a spouse only if the spouse is not eligible for Medicare or a group health plan sponsored by another employer.

- 1L Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using employee’s primary residence location ZIP code.

- 1M Individual coverage health reimbursement arrangement (HRA) offered to you and dependent(s) (not spouse) with affordability determined by using employee’s primary residence location ZIP code.

- 1N Individual coverage health reimbursement arrangement (HRA) offered to you, spouse and dependent(s) with affordability determined by using employee’s primary residence location ZIP code.

- 1O Individual coverage health reimbursement arrangement (HRA) offered to you only using employee’s primary employment site ZIP code affordability safe harbor.

- 1P Individual coverage health reimbursement arrangement (HRA) offered to you and dependent(s) (not spouse) using employee’s primary employment site ZIP code affordability safe harbor.

- 1Q Individual coverage health reimbursement arrangement (HRA) offered to you, spouse and dependent(s) using employee’s primary employment site ZIP code affordability safe harbor.

- 1R Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee, spouse, and dependents.

- 1S Individual coverage HRA offered to an individual who was not a full-time employee.

- 1T Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee’s primary residence ZIP code.

- 1U Individual coverage HRA offered to employee and spouse (no dependents) using primary employment site ZIP code affordability safe harbor.

Line 15 – This is where your Employer communicated information about the coverage that you were offered. This line will show the cost you as an employee would pay for the lowest priced plan your employer offered for self only, minimum value coverage. This may not be the plan you selected – it simply shows the lowest cost plan your employer made available to you. If you were offered coverage and were not required to contribute to the premium, then this line will be blank, or report a ‘zero’ for the amount.

Line 16 – This is where your employer communicates information required by the IRS. The Affordable Care Act requires employers to provide additional codes to fulfill their reporting obligation.

Line 17 – Use only for individual coverage health reimbursement arrangements using the employee residence or primary work ZIP code as determined by line 14 individual coverage HRA codes if offered.

Your employer may use other codes to communicate additional information about the coverage offered on Line 14, coverage affordability, if you enrolled, or why coverage was not offered. Like Line 14, these codes can change over the course of the year, so you may see different codes recorded for different months.

- 2A You were not employed any day of the month.

- 2B You were not full time (less than 30 hours/week) for the month, or left employment during the month.

- 2C You were enrolled in coverage.

- 2D You were in a Limited Non-Assessment Period – an example you might be a new employee who has to wait 90 days before they are offered coverage.

- 2E You will see this code if your employer made contributions to an employer plan, such as a union sponsored plan, on your behalf as part of a collective bargaining agreement.

The next three codes are where your employer may communicate how they determined that the coverage offered was affordable (if one of the following applies)

- 2F Affordability – Coverage for the low-cost self only plan (on Line 15) does not exceed the IRS affordability threshold of your W-2 wages.

- 2G Affordability – Coverage for the low-cost self only plan (on Line 15) does not exceed the IRS affordability threshold of the Federal Poverty Line.

- 2H Affordability – Coverage for the low-cost self only plan (on Line 15) does not exceed the IRS affordability threshold of your Rate of Pay.

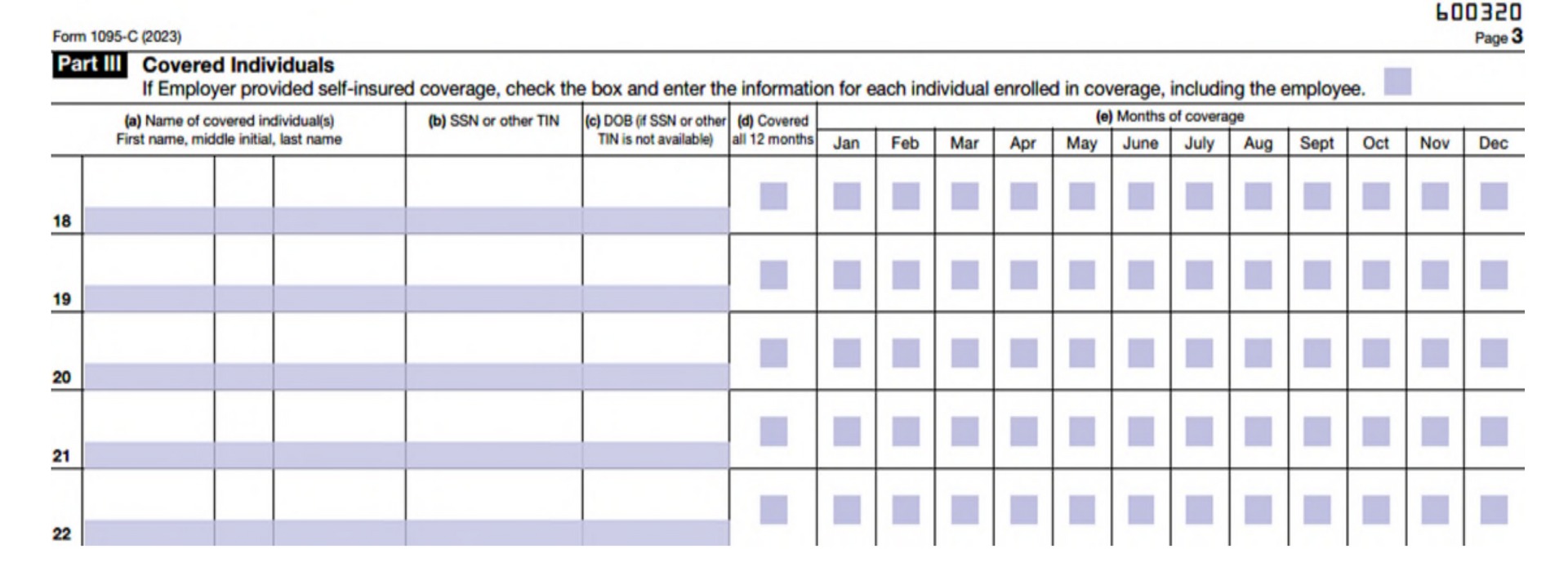

Part III:

Covered individuals for self-insured plans

If you participated in a self-insured employer sponsored health plan, Part III will be completed by your employer. It will show the name, Social Security Number, and/or date of birth of all the individuals who were covered under your policy and the months they had that coverage. Be aware that last names may be truncated in Part III (a) and it is acceptable by the IRS.

What does self-insured mean? There are two common ways an employer can structure a group health insurance plan for its employees: self-insured (or self-funded) and fully insured. The main difference between the plans is who pays the claims generated by employees. In a self-insured plan the employer pays claims directly. In a fully insured plan, the employer pays premiums to the insurance company and the insurance company pays claims generated by the employees.

If Part III is blank, and your employer’s health plan is fully insured, you should receive a Form 1095-B from your plan’s insurance carrier (or Form 1095-A if you obtained insurance through one of the Health Insurance Marketplaces).

We hope this helps make sense of the 1095-C. We have simplified some of the language and added explanations to make it easier to understand to view more information directly from the IRS visit: www.irs.gov/Affordable-Care-Act/Individuals-and-Families. In addition, when you receive your 1095-C it will come with a full set of instructions from the IRS.