Quarterly ACA Highlight:

How was your filing season?

And how did we do?

And how did we do?

As we approach the Affordable Care Act filing deadline, we are thankful for another year of working with employers, navigating them through the ACA regulations. If you haven’t yet, this is a perfect timing to revisit your compliance plans for 2023.

With that said, our clients mean everything to us, and commitment to QUALITY is one of our four core values, so please take this BRIEF one-minute client survey to help us continue to provide excellent service:

Thanks for another great filing season!

Featured Webinar

Mark your calendars and we hope you can join us for our second quarterly webinar:

A RECORD Filing Year in 2022!

As of March 15, 2023, we have filed more 1094-C and 1095-C forms than any year in Paragon’s history! It is a testament to:

- The great clients that we have, who have experienced headcount growth over the past several years coming out of the COVID-19 pandemic;

- The strong partnerships that we have forged with health and benefits brokers, who have looked to Paragon to be a go-to ACA consulting and filing resource for their clients; and

- The dedicated and incredibly knowledgeable team that we have at Paragon, both external-facing account management, and internal-facing technology team

We look forward to building upon this 2022 success to have another excellent year.

New Cost Containment Service

As a Human Resource compliance company, we are always looking for new ways to help our clients. One of our new offerings is dependent care audit services.

Paragon’s dependent care audit service validates the eligibility of dependents covered under health insurance plans. In terms of results, employers typically see immediate cost savings benefits in the month in which potential audit savings are identified, and the savings continue to accrue monthly.

An audit can also uncover other compliance risks, which can then be addressed. If you’d like to learn more, please click below to learn more:

What We are Reading

In this section, we’ve curated some relevant topics that are on our radar, from an HR Compliance and ACA Reporting standpoint.

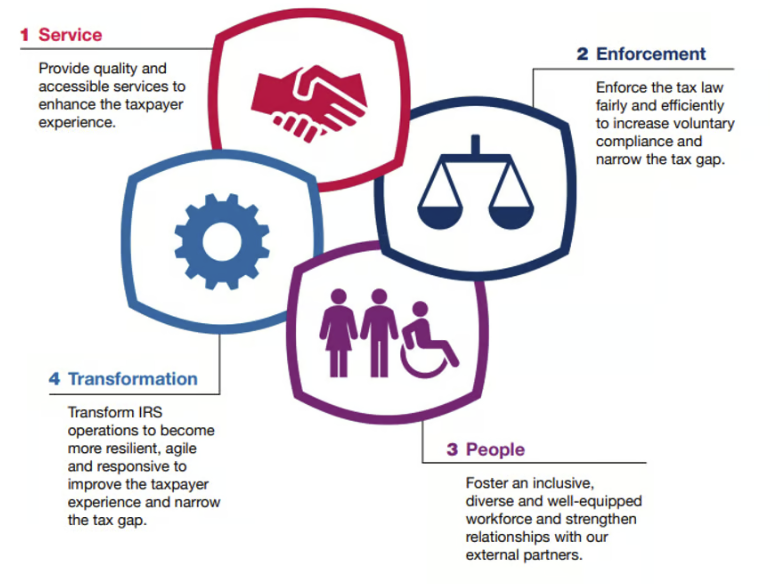

- Would you like to understand the IRS strategic plan and mission? Follow this link to read about this multi-year plan which aligns four goals to the IRS mission including objectives and strategies to meet the goals, which are included in the info-graphic below:

-

The New York State Pay Transparency Law Amendments was signed into law and is slated to take effect on September 17, 2023. The most notable revision would provide that the law applies to remote positions physically performed outside of New York that report to a New York supervisor, office, or work site.The bill’s definition broadly defines “range of compensation” as: “…the minimum and maximum annual salary or hourly range of compensation for a job, promotion, or transfer opportunity that the employer in good faith believes to be accurate at the time of the posting of an advertisement for such opportunity.”Anecdotally, there does not appear to be lower-bounded minimums (e.g., a salary range of $0 to $150,000), which remains to be seen how the law may be enforced for such wide ranges.

-

For several years now, you may be used to us moving quickly through January to prepare and mail 1095-C Forms for any California residents, as previously required by January 31 of the following year. However, beginning in January of 2023, we noted the following ACA Section of California’s Franchise Tax Board website, with the following notes:

“Insurance providers are required to report health coverage information to us annually by March 31 or face a penalty. However, no penalty will apply if the return is filed on or before May 31. Employers are similarly required to report insurance information to us by March 31, but only if their insurance providers do not report to FTB…The penalty for not reporting is $50 per individual who was provided health coverage.”

“The deadline for reporters to provide information returns to individuals is January 31, and no extensions are available. FTB does not impose a penalty for a failure to provide returns to individuals by this deadline.”

- Annual Tax Update Time: